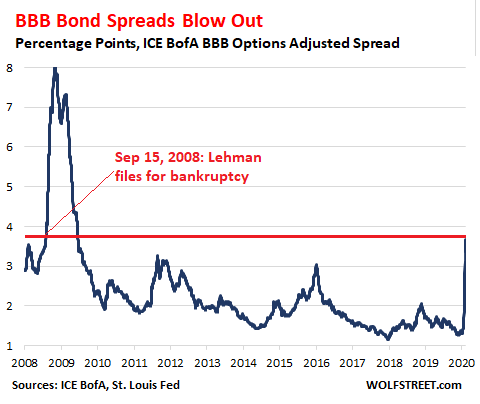

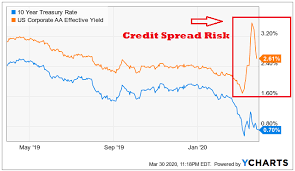

随着全球COVID-19确诊病例总数超过了100万,金融市场开始停滞不前,等待全球集中应对措施开始生效。我们都知道,是全球性流行病的传播触发了这场似乎已经无法避免的经济萧条。然而,经济下滑正逐渐发展为信贷紧缩。我们已经看到投资级别和高收益级别债券利差出现了前所未有的飙升,这意味着,整体违约率正在迅速升高。

Whilst the total number of positive COVID-19 cases exceeded the 1 million mark globally, the financial markets are stalling and waiting to understand whether the centralised global response will be impactful or not. The narrative is changing, we know the global pandemic has been the trigger for what seems to be an inevitable economic depression. However, this economic downturn is day-by-day shaping into a credit crunch. We have seen an unprecedented spike in both IG and HY spreads, meaning the overall default rate is increasing at high pace.

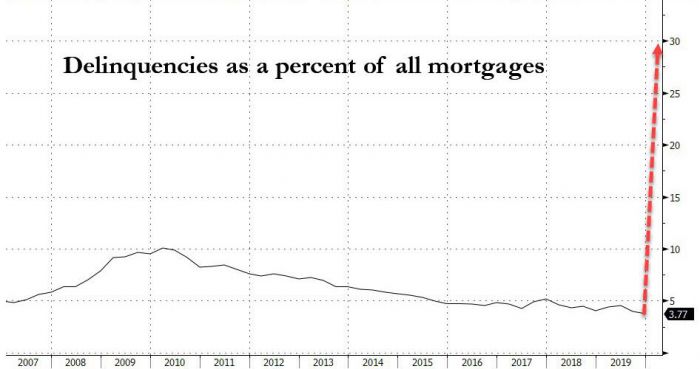

据彭博社报道,抵押贷款方正在准备迎接历史上最大的一次拖欠浪潮。根据穆迪分析公司的预测,如果美国经济继续处在封锁状态,将可能有多达30%还房贷的美国人(约1500万人)停止付款。与2008年的金融危机不同的是,这次我们只用了数周就到达了如今的局面,而那次金融危机则用了数年的时间。

At the same time, according to Bloomberg, mortgage lenders are preparing for the biggest wave of delinquencies in history. Moody’s Analytics forecast as many as 30% of Americans with home loans, about 15 million people, could cease paying if the US economy remains in lockdown. The difference between our present situation and the 2008 crisis is that this is happening in a matter of weeks and months, whilst the financial crisis, took years to develop.

与此同时,华尔街正在获利。交易量持续不减,波动性在短时间内也似乎不会很快下降,而美联储则正在以前所未见的最快速度扩展其资产负债表。

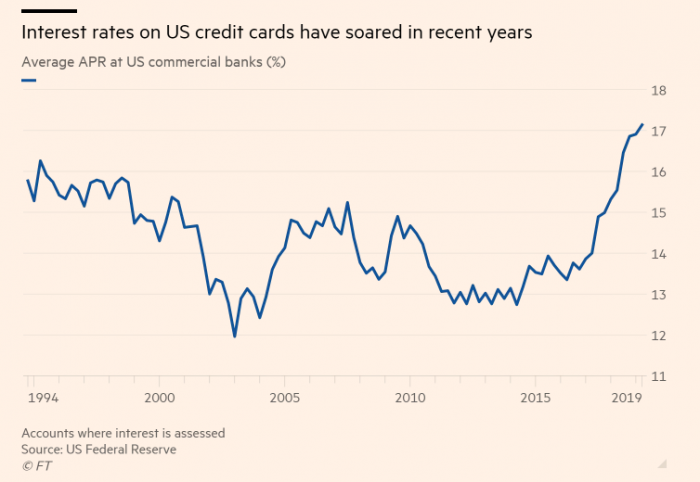

美国财政部长史蒂文·姆努钦表示,他将同意在政府批准的COVID-19救援计划中,将对小型企业收取的利率从0.5%调整至1%。也就是说,银行如今要向人们收取更高的利率,而正是这群人,在12年前的危机中拯救了它们。同样是这些银行,将1.6万亿美元的证券卖给了美联储,让美联储进一步向该系统注入流动性,从而刺激股市和信贷市场。

别忘了,这些小型企业贷款是由政府支持的,并不需要抵押品,这意味着银行(贷方)在发行这些贷款时并不承担任何内在风险。如果贷款资金可以被证明是用于支付工资、抵押贷款利息、租金或水电费,贷款甚至极大可能会免于偿还。

In the meantime, Wall Street is winning. Trading volume remains high, volatility does not seem to be declining any time soon and the FED is expanding its balance sheet at the highest pace ever recorder in history. Steven Mnuchin said that he would agree to double from 0.5% to 1% the interest rate charged to Small Businesses following the COVID-19 rescue package approved by the government. Basically, what is happening is that the same banks that got bailed out 12 years ago are now asking to charge higher interest rates to the same people that rescued them during the crisis. The same banks that sold $1.6 trillion in securities to the Fed to allow the Central Bank to further inject liquidity into the system, pumping up stock market and credit market. Let’s also not forget that these Small Business Administration loans are backed by the government and do not require collateral, meaning there is no form of intrinsic risk for banks (lenders) in issuing them. Most likely the loans will be forgiven if funds will be proved to be used for payroll costs, mortgage interest, rent or utility payments for two months if businesses retain and rehire labour force.

最后我想提一下,过去2周内,美国10年期美国国债经历了相当大的反弹。目前的收益率低于0.6%,并正以很快的速度接近历史低点0.4%,远远低于1.27%的近期高点。但投资者并没有表现出太大兴趣,也许是因为市场目前更关注石油纠纷(昨天特朗普与沙特通话后,石油上涨了25%),以及股市是否已经触底。

可以肯定的是,月末和季度末的上行压力已经结束,债券抛售和股票反弹可能即将告一段落。投资者们和交易员们正等待着接下来几周内可能出现的强大的催化剂,或者说触发因素,从而了解市场下一步方向。

未来几个月内,营收季的到来、营收指引下调、下调修订导致的多次价格峰、违约以及失业数据,这些似乎都可能成为促使股价急剧变动的因素。

To conclude, I would like to mention the quite big rally that US10Y Treasuries have been experiencing over the last 2 weeks. The yield currently stands below 0.6% and is quickly approaching the all-time-low of around 0.4%, this being way lower the recent high at 1.27%. Having not registered much interest on this massive move, maybe because investors seem to be more focussed on the Oil dispute (25% rally yesterday following Trump-Saudis call) and on whether the stock market has already bottomed for now. One thing is certain, the month-end and the quarter-end upside pressures are over and the bond sell-off along with the stocks rebound maybe coming to an end. Investors and traders are waiting for a big catalyst/trigger in the upcoming weeks to understand where the market might move to next. The earning season, cut in guidance, estimates downwards revisions leading to multiple spikes, defaults and unemployment all seem potential catalyst candidates to cause sharp moves in the coming months.

Next week our macro spotlight will be on?

下周宏观焦点

Monday:

· Factory Orders – DE 工厂订单– 德国

· Construction PMI – DE, FR, IT, Eurozone, UK 建筑业采购经理人指数–德国、法国、意大利、欧元区、英国

· Consumer Inflation Expectations – US 消费者通胀预期-美国

Tuesday:

· Interest Rate Decision – AUS 利率决定– 澳洲储备银行

· Industrial Production – DE 工业生产量–德国

· Halifax House Price Index – UK 哈利法克斯房屋价格指数–英国

· Ivey PMI – CAN Ivey 采购经理人指数 – 加拿大

· Consumer Credit Change – US 消费信贷变化-美国

Wednesday:

· Machinery Orders – JAP 机械订单– 日本

· MBA Mortgage Applications – US MBA抵押申请-美国

Thursday:

· Consumer Confidence – JAP 消费者信心–日本

· GDP Growth – UK GDP增长–英国

· Industrial Production – UK 工业生产量–英国

· Jobless Claims – US 失业救济人数–美国

· Michigan Consumer Sentiment – US 密歇根州消费者信心指数-美国

Friday:

· Inflation Rate – CHI 通货膨胀率– 中国

· Inflation Rate – US 通货膨胀率– 美国

Chart of the week

Tweet of the week 本周推文

“30% price inflation in 15 minutes on crude prices is great news for everyone…

…In the oil & gas industry…

Let's see what they will actually do.”

“原油价格在15分钟内上涨了30%,这对石油和天然气行业的每个人来说都是个好消息……

让我们看看他们实际会做什么。 “

Fact of the week 本周事件

The FED added $600bn to its Balance Sheet reaching the unprecedented total value of $5.77tn. The increase equates to an additional $1tn over the last 2 weeks and will likely continue at a $2tn month pace.

美联储资产负债表扩张了6000亿美元,总价值达到了前所未有的5.77万亿美元。在过去两周内涨幅为1万亿美元,并且可能继续以每月2万亿的速度增长。

| Stefano SciaccaSciacca拥有专业的资产投资经验,曾就职于大型金融机构如伦敦证券交易所和高盛。现任职瑞麟资本的投资经理一职。Stefano在股票公开市场有非常深入的研究和丰富的知识。 |

|  | 今日华闻版权所有 未经许可不得转载 © ihuawen.com 2010-2015 |