Risk management has always played a crucial role when building a cross-asset portfolio. However, most investors believe risk management is a powerful tool to limit potential losses or downside on the portfolio’s performance. The truth is that risk management should actually be seen as a way to generate extra profit in periods of market uncertainty and turmoil.

在建立跨资产投资组合时,风险管理一直扮演着至关重要的角色。尽管大多数投资者认为,风险管理在预防潜在损失和投资组合表现恶化方面是强有力的工具。但实际上,风险管理还应该被视为在市场不确定性升高和动荡时期获得额外利润的一种方式。

Within the intrinsic market variability, what technicians define standard deviation or historic volatility, very few people amongst the “bear” community seem to pay particular attention to fat tails and black swans events.

在专业上用“标准差”和“历史波动性”定义的市场内部变化性上,看跌的投资者极少会特别关注“肥尾效应”或“黑天鹅事件”。

These types of events, as defined by the infamous finance professor Nassim Taleb, are extremely unlikely and very rare negative events which impact a specific economy (or portfolio if contextualised within the investment universe) as an exogenous shock, something that is not foreseeable or predictable anyhow.

“黑天鹅”理论由业界闻名的金融学教授纳西姆·塔勒布(Nassim Taleb)提出。它是极少见的消极事件,会作为一种外来冲击对特定经济体产生影响;如果在投资范畴讨论,则影响对象为投资组合。它是不可预见的,也是不可能预测的。

One recent example has been the Lemhan Brothers’ collapse as never happened in history that such a big and influential investment bank would let fail, distressing the worldwide financial communities and causing a huge spike in systemic risk.

最近发生的一个例子就是雷曼兄弟公司(Lemhan Brothers)的倒闭。如此庞大而有影响力的投资银行倒闭,这是在历史上从未发生过的事。这让全世界的金融界都感到不安,并导致了系统性风险激增。

In mathematical terms, given that we gauge the stock market variability as the distance between periodic returns and their mean (standard deviation), a black swan or fat tail event (referred to extremely unlikely event placed at the bottom of the normal distribution tails) has an outcome which shakes the stock market by more than 2 times its standard deviation (recognised from economics and financiers as the upper and lower band of a “normal” stock market distribution).

用数学术语来说,假设我们以周期性收益与其均值之间的距离(即标准偏差)来衡量股票市场的波动性,那么“黑天鹅”或“肥尾”事件(指在正态分布下尾部出现的极不可能发生的事件)给股票市场带来的震荡会超过其标准偏差的2倍以上。2倍标准偏差,在经济学和金融家的眼中,是“正常”股票市场分布中的上限和下限。

What we have seen in the Great Financial Crisis and what we are seeing right now can be categorized as Black Swans from both a qualitative and quantitative perspective. Qualitative because the COVID-19 impact was and still remains unpredictable, quantitative because the following volatility is way above the “normal” level.

从定性和定量的角度来看,我们在2008年金融危机中所看到的,以及我们现在所看到的都可以被归类为“黑天鹅事件”。定性是因为COVID-19的影响仍然是不可预测的,定量是因为它带来的波动远高于“正常”水平。

The role of a responsible portfolio manager (or an investor) requires to also allocate a small amount of the money under management in tools and securities whose task is to minimise the impact of such disruptive events.

一些金融工具和产品能使此类破坏性事件的影响降低到最小化,而负责任的投资组合经理(或投资者)需要在资产配比中将小部分的资金投入这类金融工具和产品。

As a consequence, the hedging positions will be massively loss-making when the economy and the stock market thrive, whilst will be more than offsetting the portfolio’s losses once a downturn in the economy and, consequently, in the stock market might start.

当经济和股市蓬勃发展时,这些对冲头寸将大量亏损,而一旦经济下滑,进而可能导致股市低迷,对冲头寸将充分抵消投资组合的亏损,甚至带来额外收益。

There are several securities and asset classes that can be used for this specific purpose. Options are by far some the most preferred by investors given their fair live pricing, their market depth, their liquidity and their ease to be widely understood by the investment community. Once all the variables affecting the options pricing are clearly understood, any investor can hedge or speculate through them.

有几种证券和资产类别可用于此特定目的。目前来说,期权由于其公平的实时定价、市场深度高、流动性好以及作用易于被投资者理解的优点,被投资者偏爱。在清楚地了解到影响期权定价的所有变量后,任何投资者都可以使用期权进行对冲或投机。

Options are extremely powerful securities whose value derives from the spot price of their respective underlying asset (i.e. Stock, Index, Bonds, FX). They can be exercised at maturity only (European) or before (American, Bermudan). The trigger that actionate the options, and lifts their value up, is the Strike Price of the underlying asset, a fixed price where the spot price has to be compared to understand if the option is in the money, out of the money or at the money (spot price=strike price).

期权是一种功能非常强大的证券,它的价格根据其标的资产(即股票、指数、债券和外汇等)的现货价格而衍生而来。欧式期权要求持有者只能在到期日执行,美式期权和百慕大期权则在到期日前的任何时间都可以执行。预先设定的行使价是触发执行期权以及提升期权价值的关键因素。通过对比行使价与现货价格,我们来判定它是虚值期权、实值期权还是平值期权(现货价格=行使价)。

Without getting too much into the technicalities, options give investors an opportunity to generate alpha, and hedge, when the underlying asset changes in value without actually holding it.

简而言之,期权可以让投资者无需实际持有标的资产。当标的资产价格发生变化时,持有期权让投资者产生了获取阿尔法收益(α)和对冲的机会。

In fact, any option gives the right to buy (Call) or sell (Put) a specific underlying at a specific fixed price (Strike Price) and Maturity (Expiry date). Given that in finance there is no such a thing as a “free lunch”, any investor has to pay for the privilege of potentially gaining (and not losing as the out of the money option would not be exercised) from an asset not held. Hence, they have to pay for the premium.

实际上,任何期权都给予了投资者以特定的价格(行使价)在到期日买入(看涨)或卖出(看跌)某种特定标的资产的权利。鉴于在金融世界中并不存在“免费的午餐”,任何投资者都必须为这种特权有所付出,因为当标的资产价格提升时,投资者获得收益,当标的资产价格下降时,投资者不执行期权从而不承当损失。他们因此支付期权溢价。

The premium of an option is the price that any investor has to pay to have the right to buy/sell any specific related underlying asset. The more spot price of such underlying approaches the trigger (strike price) and the more likely the option is to get in the money. If this happens, the premium of the option will appreciate and the holder will start seeing massive gains.

期权溢价是为了获得购买/出售特定标的资产权利时投资者需要支付的价格。挂钩标的资产的现价越接近行使价,期权就越有可能成为实值期权。那么,期权的溢价也将上涨,持有人则会开始看到巨大收益。

Furthermore, given that the options have many intrinsic variables used to derive their values, such as time, interest rate, market volatility, sensitivity to market moves etc etc, the appreciation or depreciation of the premium is not linear and is not proportional to the related underlying asset change in price.

此外,由于期权具有许多用于推导其价值的内在变量,例如时间、利率、市场波动性,以及对市场走势的敏感性等,因此溢价的升值或贬值并不是线性的,并且与其标的资产价格都变化不成比例。

During this recent market turmoil caused by both a price war on crude oil and the COVID-19 panic, Options are thriving thanks to the big swings that the market has been experiencing over the last three weeks.

在近期因原油价格战和COVID-19恐慌而引起的市场动荡期间,市场三周以来持续经历大幅波动,而期权则受到追捧。

The “fear” Index, also called VIX or Volatility Index, gives a proxy of the 30-60-90 days implied volatility of each constituent of the SP500. When any investor buys an option he is automatically long “volatility” as he buys the likelihood of whatever underlying asset to move upwards (Call) or downwards (Put).

被称为“恐慌”指数的波动率指数(VIX)代表了标普500各成份股30-60-90天的隐含波动率。当投资者购买期权时,他就自然地选择了做多“波动性”,因为他买的是标的资产上涨(看涨)或下跌(看跌)的可能性。

The result has been a general appreciation of options and especially of Put options on the SP500, purchased to bet on the market shortfall. Volatility (VIX) call options have also gained a decent return as they are negatively correlated to the SP500, hence they are more likely to be in the money the the US stock market collapses rather than rallying.

结果是——期权普遍升值,尤其是标普500的看跌期权,用来赌市场下跌。波动性(VIX)看涨期权与标普500呈负相关,因此也获得了可观的回报,因此它们更有可能在美国股市下跌时带来收益。

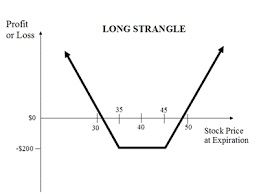

Kylin Prime Capital decided to implement an option strategy to be long volatility on the SP500. The strategy is called Strangle and consists in buying 2 options, one call and one put, with different strike price and maturity date. Specifically, the call option needs a higher strike price than the put option. The price of the strategy equals the sum of the two premiums, while the potential positive payoff implies a 10+ percent move upwards on downwards.

在瑞麟资本,我们的投资经理决定采取一种做多标普500波动性的期权策略。该策略被称为宽跨式期权(Strangle),包括购买一个看涨期权和一个看跌期权,它们分别具有不同的行使价和到期日。特别的是,看涨期权比看跌期权的行使价更高。实施该策略的成本等于两个期权溢价的总和,而上涨或下跌10%以上均意味着潜在的正收益。

We decided to launch this strategy after weeks and months of market stagnation, frustrated by steady appreciation of the SP500 fragmented by quick and small price correction always promptly rebounded, amid economic global slowdown especially in the manufacturing sector. We expected a big market meltdown to hit the global economies, while timing was of course uncertain and confidence on the market was so high that we decided anyway to capture any upside of it.

在全球经济放缓(尤其是在制造业领域)的背景下,标普500此前不断受到快速和小幅价格调整,但依然稳定升值。在经历了数周甚至数月的市场停滞之后,我们决定启动此策略。我们预测市场将会崩溃,全球经济将会受到严重打击,但时机是不确定的。之前市场信心如此之高,我们也不愿意放弃市场继续上行的机会。

When the COVID-19 outbreak hit Europe and fear started to panic investors supported by supply-chain disruption, slowdown in exports, FX devaluations, deflation, deteriorating consumer spending, falling airline companies and so on, the stock market finally started to break lower. We were prepared and we are capturing any downfall.

但当COVID-19疫情席卷欧洲后,供应链中断、出口放缓、外汇贬值、通货紧缩、消费者支出恶化以及航空公司下跌等导致投资者开始恐慌时,股市终于开始下跌。我们已经做好了准备,正在捕捉下跌中的获利可能。

Any investor should be prepared for the worst at any time, even when optimism spreads around the investment community and complacency around the markets seems unstoppable. We will see where the market is headed and how the central banks and respective governments will handle the issue both from a healthcare and economic point of view.

投资者随时都应为最坏的情况做好准备,即使整个市场蔓延着乐观情绪,或者市场的自满情绪看似不可阻挡。市场将如何发展?中央银行和各个政府将如何从医疗健康和经济两个方面来处理问题?我们拭目以待。

| Stefano SciaccaSciacca拥有专业的资产投资经验,曾就职于大型金融机构如伦敦证券交易所和高盛。现任职瑞麟资本的投资经理一职。Stefano在股票公开市场有非常深入的研究和丰富的知识。 |

|  | 今日华闻版权所有 未经许可不得转载 © ihuawen.com 2010-2015 |