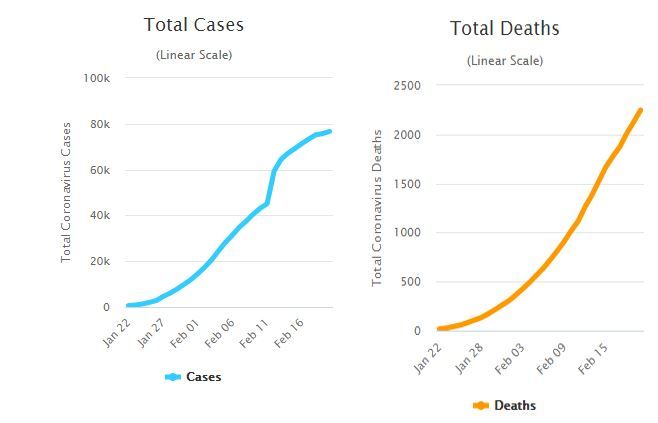

With the Coronavirus registering 76,802 (Cases) - 2,250 (Deaths) - 18,822 (Recovered), these are the numbers that everyone seems to be keeping under the spotlight. Whilst the number of infected people is starting to show signs of deceleration (see chart below), the deaths count continues to edge higher as we surpass the 2000 level.

至截稿时,新型冠状病毒肺炎已有76802例确诊,2250例死亡,18822例治愈,所有人每天都关注着这些数字。尽管确诊人数增长已有减缓趋势(见图1),但死亡人数仍在上升,超过了2000人(见图2)。

The capital markets are of course positioning accordingly, and they are highlighting “mixed” signals. One day equities are rallying, gold follows and yields spike, another day equities sharply decline (yesterday the SP500 plunged more than 1% intraday), gold continues to hike, and yields fall. It is all a bit confusing, it seems like active market participants do not really know where to position themselves in order not to be overly exposed to the Virus updates (few large companies across different sectors are already profit-warning for Q1 2020), but also the challenge is to not “miss out” on any upside potential (tech companies continues to thrive, whilst Q4 earnings season and global macro data seem to strengthen a deteriorating global growth outlook).

资本市场当然会随着事态发展对各种“混合”信号做出反应。前一天股票上涨,黄金紧随,国债收益率飙升,紧接着后一天股票就急剧下跌(例如昨天标普500盘中暴跌逾1%),黄金继续上涨,国债收益率下降。这让人感到困惑。活跃的市场参与者似乎并不真正知道自己应该怎样不要对病毒进展过度反应,在市场中找准自己的定位。(一些不同行业的大公司已经发出2020年第一季度业绩预警)。同时,他们也不想“错过”任何上行潜力(科技公司继续蓬勃发展,第四季度财报季和全球宏观数据也为正在持续恶化的全球增长前景注入新动力)。

What appeared to be a clear pattern is the inevitable growth in price of gold which definitely came out as the “preferred” asset for the equity outflows. Bitcoin, for many the new “digital gold”, also is having the best YTD performance (+36% vs 4.5% for SP500 & 7.8% for Gold) following the 2019 bear market.

金价的上涨已经势不可挡,黄金无疑是减仓股票后的“首选”资产。在2019年熊市之后,作为新的“数字黄金”,比特币年初至今的表现也达到最佳(年初至今上涨36%,而SP500为4.5%,黄金为7.8%)。

Volatility is also back. That is the main “positive” news. Banks will benefit from larger trading volumes and, in general, more frequent trading activity. The Volatility Index, which tracks the implied volatility of the 500 constituents within the SP500, has finally recovered from the bottom level of roughly 12 to the YTD high of 20. Moving forward, it may not be surprising if gold perhaps struggled at the $1600 per ounce level and the SPX reached a new all-time-high in the next month.

市场波动正在回归,这是主要的“积极”新闻。银行将从更大的交易量和更频繁的交易活动中受益。波动率指数追踪标普500内500个组成公司的隐含波动率,近日终于从约12的底部反弹至20,为年初至今的高点。展望未来,如果我们看到金价停留在每盎司1600美元的高位,而标普500同时在下个月创下历史新高,也并不会感到奇怪。

Long-term, it could be expected that the virus aftermath could start hitting the “real economy” between Q1 and Q2, meaning a deteriorating consensus from brokers and lower guidance (Profits, Cash-Flows and Dividend especially) for companies. If equity investors feel disappointed due to lower-than-expected cash returned to shareholders in forms of dividends or buybacks, then we will likely see a bearish sentiment spreading out.

从长期来看,我们可以预期病毒将在第一季度和第二季度之间开始对实体经济产生影响,这意味着经纪人在经济情况恶化这一点上达成共识(特别是公司利润、现金流和股息)。如果以分红或回购的形式返还给股东的股利低于预期,股票投资者将感到失望,引发看空情绪的蔓延。

Elections in the US, UK-EU deals, US-China Trade negotiations and other geopolitical uncertainties (Iran?) continue to feed extra caution for this year.

美国的选举、英国和欧盟的谈判、中美贸易谈判和其他地缘政治的不确定性(比如伊朗)是今年特别应该保持谨慎的原因。

Next week our macro spotlight will be on?

下周宏观焦点

Monday:星期一:

● Ifo Business Climate – Germany Ifo 商业环境–德国

● Dallas Manufacturing Index - US 达拉斯制造业指数-美国

Tuesday:星期二:

● GDP Growth – Germany GDP增长–德国

● House Price Index – US 住房价格指数–美国

● Richmond Fed Manufacturing Index - US 里士满联储制造业指数-美国

Wednesday: 星期三:

● New Home Sales - US 新屋销售量-美国

Thursday: 星期四:

● Business Confidence – Eurozone 商业信心–欧元区

● Housing Prices – UK 住房价格–英国

● GDP Growth – US GDP增长–美国

● Durable Goods – US 耐用品销售额–美国

● Unemployment Rate – Japan 失业率–日本

● Retail Sales – Japan 零售业销量-日本

● Industrial Production - Japan 工业生产-日本

Friday: 星期五:

● Gfk Consumer Confidence – UK Gfk消费者信心指数-英国

● GDP Growth – France GDP增长–法国

● Unemployment Rate – Germany 失业率–德国

● Inflation Rate – Eurozone 通货膨胀率–欧元区

● Chicago PMI – US 芝加哥PMI –美国

● Michigan Consumer Sentiment – US 密歇根州消费者信心指数-美国

● Personal Spending/Income - US 个人支出/收入-美国

Chart of the week

本周图表

Fact of the week

本周事件

A.P. Moller-Maersk, the largest container shipping company worldwide, announced a significant impact on its FY2020 guidance as demand might see a “sharp” rebound due to the COVID19. They now expect a weaker start of the year.

全球最大的集装箱运输公司A.P. Moller-Maersk宣布由于新型冠状病毒,需求可能会出现“急剧”反弹,这对其2020财年的业绩指引产生重大影响。他们现在预计今年年初业绩会较差。

Quote of the week

本周语录

“Apple's iPhone sales in China could fall 40-50% in February and March due to the coronavirus outbreak”Global Times

“由于冠状病毒的爆发,苹果在中国的iPhone销量在2月和3月可能下降40-50%”。——《环球时报》