Here we are, once again the Federal Reserve, arguably the most influential central bank worldwide, decided to intervene by cutting the base interest rate by 50 basis points to 1 – 1.25%. The unexpected decision came out a few moments after the G7 conference call between the main central bankers and G7 Finance Ministers and stated basically that no major intervention would be implemented although they would keep a close eye on the virus impact on the real economy. Now, the capital markets have firstly welcomed the rate cut, but then they rejected the decision as not “enough” to discount such a source of disruption as the COVID-19.

我们看到,全球最具影响力的中央银行——美联储再次出手,决定将基准利率降低50个基点至1-1.25%。在七国集团主要央行行长和七国集团财长共同参加的电话会议后不久,美联储就公布了这个令人出乎意料的决定。美联储称,尽管他们将密切关注病毒对实体经济的影响,但不会实施任何重大干预措施。资本市场起初的反应是欢迎降息,但随后给出了相反的态度,因为50几点的降息“不足以”抗衡像COVID-19这样给经济带来的冲击。

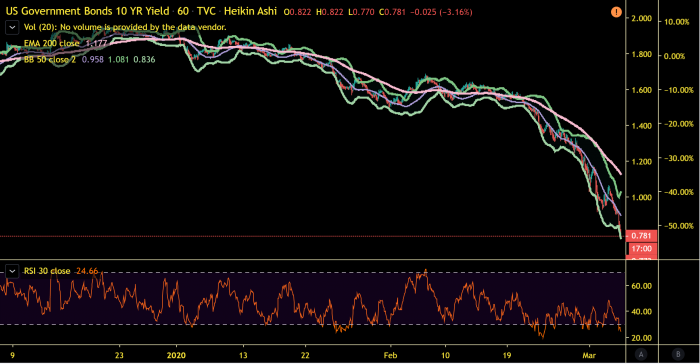

The equity market immediately jumped 1.5% momentarily following the Fed’ press release to then fall back almost 5%, closing roughly 3% down on the day. The bond market, on the other hand, not only kept rallying on the Fed’s liquidity inject, but it then stretched to the historically lowest 0.7% US 10Y Treasuries Yield (see “Chart of the week” below).

在美联储发布新闻后,股票市场立即跳升1.5%,随后回落近5%,至当天收盘下跌约3%。另一方面,债券市场继续在美联储注入流动性的刺激中上涨,美国10年期美国国债收益率0.7%(见下文“本周图表”)随后延伸至历史最低点。

The outcome unfortunately for the Fed not been as good as expected, as the credit market is now pricing in a further cut of 50 basis points during this month’s FOMC meeting. If the Fed does decide to follow the market’s expectation, then the United States of America will not have any protection if/when recession finally floods the economy, bringing a high unemployment rate, low consumer spending and credit, crashing housing market and, last but not least, corporate defaults due to poor cash flow generation.

不幸的是,美联储的行动并没有带来预想之中的好结果,因为债券市场目前已经在价格中考虑了进一步的降息预期,期待本月即将举行的下次联邦公开市场委员会会议中,美联储将进一步下调50个基点。如果美联储最终决定满足市场的预期,那么假如经济衰退席卷而来,造成高失业率,低消费率和低信贷,房地产市场崩溃,以及更严重的,公司纷纷由于现金流不足而违约,那么美联储将没有任何“后手”,使美国经济失去保护。

This could start the infamous “capitulation phase” where investors just panic and run for cash & equivalents like investments. The COVID-19 fear, which in the first 2 months of 2020 has been dramatically underestimated, has potentially a massively disruptive power in economic terms.

这可能会引起臭名昭著的“投降阶段”的开始,在这一阶段,投资者会惊慌失措,争先恐后将自己的投资变现。在2020年的头2个月里,人们对COVID-19病毒的恐惧被市场大大低估,如今它在经济方面的巨大的破坏力正慢慢显现。

Simply put, people won’t consume, won’t spend, won’t buy houses, won’t go to work and likely won’t even interact with other humans for fear of contracting the virus from asymptomatic individuals. Meanwhile, bars, transportation vectors, grocery shops, cinemas, train stations, post offices, local bank branches will all be shut down. That might sound like a plot of a Sci-Fi movie, but it mirrors what has been happening in the Northern Italian regions for the past couple of weeks. Economy stagnation, extremely low inflation (due to both no spending and zero interest rates) and supply-chain disruption are on the way.

人们会因为担心被病毒潜伏期的人群感染而停止了消费、买房和上班,甚至是与人接触。同时,酒吧、交通枢纽、超市、电影院、火车站、邮局和当地银行都将全部关闭。这听起来像是科幻电影里的情节,但过去的两周里却真实地在意大利北部地区上演。未来将出现经济停滞,极低的通货膨胀率(由于消费低和零利率),以及供应链中断的情况。

The main hope is that the healthcare system, top pharma top companies the WHO and the most powerful countries in the world will for once focus on finding a cure/vaccine to assist infected people and prevent further contagion. While central banks are now hopeless as their impact on the real economy equates to zero as they only seem to focus on the “health” of the financial system, ultimately harming it, the governments CAN still stimulate the economy from a tax cut perspective and should incentivise people to avoid any gathering or crowded place for the time being.

我们现在只能将希望寄托于医疗保健系统、世界卫生组织、顶级制药公司和世界上最强大的国家专注于寻找治愈方法或者疫苗,来帮助感染者,并防止进一步传染。尽管各国央行现在对实体经济的影响几近为零,因为它们似乎只专注于金融体系的“健康”,但却最终损害了它。各国政府仍然可以从减税的角度刺激经济,并且应该激励人们暂时避免聚会或去人群密集的地方。

Together we can all hope for a de-escalation and hopefully in a few months this terrible threat will only be in our nightmares. On a positive note, when all of this will be over, the stock market will offer value and be easily accessible that everyone will have the opportunity to ride the next bull-run.

现在我们共同希望疫情形势迅速得到控制,并且期待在几个月内,这个可怕的威胁将只会出现在我们的噩梦中。积极的一面是,当这一切都结束后,股票市场将提供价值机会,而每个人都将有机会踏上下一轮牛市的浪潮。

Next week our macro spotlight will be on?

下周宏观焦点

Monday:星期一:

· Balance of trade – Germany 贸易平衡–德国

· Industrial Production - Germany 工业产量-德国

Tuesday:星期二:

· Inflation Rate – China 通货膨胀率–中国

· Machine Tool Orders – Japan 机床订单–日本

· GDP Growth Rate – Eurozone GDP增长率–欧元区

· Unemployment Rate – South Korea 失业率–韩国

Wednesday:星期三:

· GDP Growth Rate – UK GDP增长率–英国

· Industrial Production – UK 工业产量–英国

· Manufacturing Production – UK 制造业产量–英国

· Inflation Rate – US 通货膨胀率–美国

Thursday:星期四:

· Industrial Production – Eurozone 工业产量–欧元区

· ECB Interest Rate Decision 欧洲央行利率决定

Friday:星期五:

· Vehicles Sales – China 汽车销售–中国

· Inflation Rate – Germany 通货膨胀率–德国

· Bank Of England Meeting 英格兰银行会议

· Michigan Consumer Sentiment - US 密歇根州消费者信心指数-美国

Chart of the week 本周图表

Fact of the week 本周事件

The Federal Reserve unexpectedly cuts the base interest rate in the USA by 0.5%, few minutes after zero outcome G7 emergency conference press release stating “We, G7 Finance Ministers and Central Bank Governors, are closely monitoring the spread of the coronavirus disease 2019 (COVID-19) and its impact on markets and economic conditions”.

毫无结果的七国集团紧急会议新闻稿声称,“我们,G7国家的财政部长和中央银行行长都在密切关注新型冠状病毒的传播及其对市场和经济状况的影响”。几分钟后,美联储出人意料地将美国的基本利率降低了0.5%。

Quote of the week 本周语录

“Fundamentals of the US economy remain strong”

“美国经济的基本面保持强劲。”

Fed Chairman, Jerome Powell moments after cutting the Fed rate by 50 basis points

美联储主席杰罗姆·鲍威尔在将美联储利率降低50个基点后的片刻说道。

| Stefano SciaccaSciacca拥有专业的资产投资经验,曾就职于大型金融机构如伦敦证券交易所和高盛。现任职瑞麟资本的投资经理一职。Stefano在股票公开市场有非常深入的研究和丰富的知识。 |

|  | 今日华闻版权所有 未经许可不得转载 © ihuawen.com 2010-2015 |